Elite runners focus on every step of every run. Us mere mortals seek displacement tricks to block out the pain. And so I found myself on a long, sweltering marathon training run reflecting on last week’s extraordinary developments in sport that had Middle Eastern money at their core.

My mental meanderings were prompted by an early morning interview on a local radio station. A producer had stumbled on the original Sport inc. book. Its subtitle - why money is the winner in the business of sport - wrapped up her agenda: LIV Golf, Karim Benzema to Al Ittihad, Man City winning the treble and a third Prem rugby team going bust. “Are we losing something?” the presenter asked me.

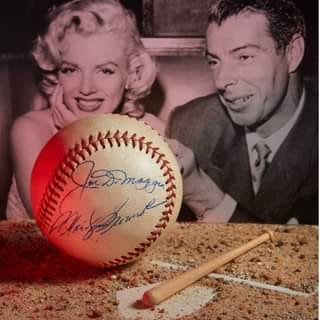

Are we? Sport is glamorous, but that’s long been the case - think DiMaggio and Monroe. It’s certainly ubiquitous now, but only in the way that all entertainments are in the social media age. Standards seem higher, but who are we to say Ali wouldn’t have beaten Fury or that Bannister might not have bested Ingebrigtsen given the same shoes, tracks, sport science and training regime? Fitter, more technically accomplished stars aren’t guaranteed to produce greater thrills, whatever the hype.

This is no reverie about bygone ages. Stakes might be higher now, and often blamed for poor behaviours, but greed, corruption and cheating have been with us since the ancient Olympics and doubtless beyond. Think shoe money and blood doping in athletics’ so-called ‘golden era’ which coincided with the sport becoming professional in the early 1980s.

The waves of money Saudi Arabia and its neighbour states are sinking into sport will change where it is played, what we will see on our screens, and who wins. More importantly, it will determine the losers - where sport won’t be played, what we will struggle to find online, and those that will sink back into amateur status or even disappear.

“The PGA Tour is, and remains, an American institution.” Jay Monahan, tour commissioner

It was thoughts of these losers that fuelled my run. Not Rory McIlroy. Sure, he’s angry and maybe embarrassed. But there’s a chance now he may have a coherent, global calendar of individual and team events to play for eye-watering prize money deep into his golfing dotage.

Nor Andy Murray who may be right that the Saudis will come for tennis next, but who will have the luxury of being able to avoid playing in the kingdom itself. And not fans of those superstar footballers lured to the Saudi Pro League as there will be no shortage of talent to backfill them in the established European leagues.

There is now a scramble to dip into the oily and gaseous resources evidently earmarked by the controllers of the Middle Eastern states for diversification into sport. The media may cry ‘sports wash’ but the capitulation by the PGA and DP World tours has wedged open the door for other owners of sporting assets to pile through.

Saudi oil revenues totalled $326 billion in 2022, delivering 8.7% GDP growth and the kingdom’s first budget surplus for a decade. Its Public Investment Fund was worth around $530 billion at the end of 2021

There are a handful of sports consultancies whose business models now rest largely on enabling Saudi Arabia to deploy its money effectively in sport, not only by investment in elite events but also in grassroots activity. Their expertise is such that you can be sure there is coherence to the kingdom’s strategy, however repellent its tactical pursuit might at times appear to be.

The FIFA World Cup and Olympics are the two big prizes. Expect both to be hosted by Saudi in the next couple of decades, possibly as part of a consortium of hosting nations. The kingdom’s World Cup ambitions suggest its football investment is likely to prove more durable than other ventures around the world that have seen brief flirtations with expensive, marquee player signings.

The Olympics target bodes well for a number of the Games’ constituent sports, many of which could be wrapped up and ‘owned’ for a fraction of the price of a top football club. A few hundred million dollars a year and you could create a thriving athletics circuit, bankroll World Athletics and transform the prize and appearance money for the best athletes - in effect breaking the sport out of its reliance on a single quadrennial jamboree. Provided you could find a way to collaborate with the dominant shoe companies in any new construct.

Imagine being a sport that is rocked by these shifting tectonic plates, is short of cash but does not fit into the grand strategy. How does British rugby (both codes), say, fit into to a world where location is increasingly irrelevant to where sport is hosted and what matters instead is the money thrown behind its promotion? The Premiership isn’t currently functional with a salary cap of just £5 million a club - chump change in the new world in which sovereign wealth funds trump private equity, and the latter has conspicuously failed to solve the problem to date.

Around half of the world’s population live in liberal or electoral democracies. Half don’t. Muscles are being flexed in the tussle for sporting power on both sides of this divide. Expect more expedient parking of ideals in the frenzied search for investment from the ‘wrong’ side.

Niche, local, loyal, heritage and amateur aren’t always fashionable tags. Embracing them, though, may prove the route to a healthy future for those many sports inevitably left behind in the race for world domination. One foot in front of the other, step after step.

Judge them by their actions

Brentford striker Ivan Toney spent the four year period in which he broke football’s betting rules playing in the EFL. He has been banned for eight months. Last week the EFL agreed a new five year deal with its headline sponsor, Sky Bet. This does include “a player education programme across the EFL’s 72 clubs that will focus on the potential dangers of gambling and provide support and advice.” Even so…

The siren call of La La Land

I’m getting a sense within Olympic and Paralympic sport that already LA 2028 not Paris 2024 is considered the big one. Maybe it’s because America stuffed up so badly in 1996 with Atlanta, or perhaps because those derided, venal Games paved the way for the orgy of commercialism that the Olympics represents and the USA is deemed the host most likely to take that now to its extreme. Think Super Bowl meets Hollywood. Expect to be sick of hearing the Star Spangled Banner as the home team crushes the medal table, and don’t expect to be able to secure a ticket for the men’s basketball final - most likely the last event before a shamelessly overblown closing ceremony.

Who nose?

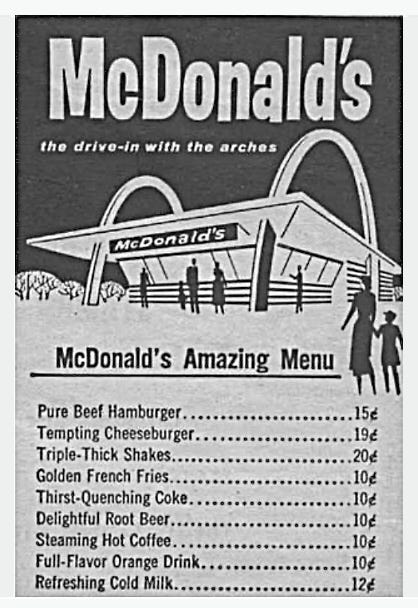

The Sport inc. sporting smell correspondence continues. One reader was prompted by last week’s mention of Deep Heat to say that the whiff of the linament on the players emerging from the tunnel at Bromley FC in the 1980s always reminded him of the smell of McDonald’s root beer. Google tells me sales of this fizzy drink finally fizzled out in the UK in 1993. Still missed.

Thanks Ed - an especially good one!

V thought provoking as always.

On Saudi investment and which sports might be next (tennis?), I was reflecting on PIF vs PE investment strategy in sports and whether or not they are the same? Assuming PE invests where there is value creation opportunity. F1 good example of where this was identified and so far well executed. But whether PIF just buys the existing value in properties or more likely a combination of both.

The to the question of top 10 investable sports or properties worldwide what would be 1 to 10, depending on your view of the above?

I would have professional rugby union near the top. Will wait for my next long train journey to think on the other 9! Interested in your take