Unless the media have been blindsided by a canny investment bank, it seems that there are no sovereign wealth funds or squillionaires left in the running to buy Chelsea. No Musk, Bezos, Chinese tech magnate or gas-rich autocracy. The three remaining bidders, as reported, are all consortia. Let the game theory commence.

The selling bank, Raine, has an unusual set of parties to satisfy before it trousers its fee. Frozen owner Roman Abramovich. His hired hands at the club, led by chair Bruce Buck, all of whom will have an eye on their own jobs and no doubt still have a hotline to the oligarch. The Premier League wafting its flimsy rules on ownership. And the UK government keen to avoid any fuss having already banked its geopolitical capital by targeting Abramovich.

This confluence of interests may well ensure that clean hands and continuity at the club trump price in the selection of the final victor. It still seems odd that Abramovich will have a major say in the choice, but then his assets have merely been iced not seized. With the proceeds destined for victims of the war in Ukraine, one might have thought that he and the government would be keen to squeeze every last penny out of the buyers, but don’t hold your breath. Indeed it may be that those with the greatest interest in Raine extracting the very last possible penny from the sale are Chelsea’s rivals.

What is clear is that Chelsea’s financial future will be very different in new hands. No longer a single decision-maker with deep pockets and no apparent profit imperative. The new owners won’t only have to stump up £2.5 billion plus in hard equity. There will be perhaps up to £100 million in fees for advisors and financing, a chunk of cash to cover contract renegotiations and summer transfer activity, plus a pot of working capital to lubricate the business.

It’s inconceivable that each of the three reported consortia comprises parties all happy to chip into such a substantial pot without expectation of a handsome return on their investment over a reasonable timeframe. This isn’t chump change.

Key to Raine’s work will be its testing of the dynamics underlying each of the bidding groups - their decision-making protocols, the investment agreements they rely on, the potential breaking points in any stressful situation, the exit routes baked into their business plans. Only then can Abramovich decide what he believes is best for Chelsea and the government assess its own reputational risk in endorsing a deal.

“In the process of finalising the proposal, it became increasingly clear that certain issues could not be addressed given the unusual dynamics around the sales process.” The Ricketts-Griffin-Gilbert consortium’s statement on withdrawing last week

The higher the headline price, the sooner the test of a consortium’s resilience and agility will come. Expect the rest of the Premier League clubs to lean on government to ensure that they don’t simply nod through a sweetheart deal that leaves cash on the table.

Peaky blinders

The Premiership’s tighter £5 million salary cap, a Covid introduction, is giving some clubs migraines. Bristol Bears were alleged to be offloading players after failing to balance their books. There is talk of clubs becoming uncompetitive in the international market for box office stars. The RFU’s current policy of only picking those who play in England for the national team is some protection, but just as social protocols have eased, so a return to pre-pandemic financial regulations makes sense.

“Bristol Bears are aware of reports in the Telegraph on Thursday, March 31. The club reiterates its commitment to salary cap compliance and we continue to work closely with PRL. We categorically state that we have been, we are and will continue to be under the salary cap.” Statement from Bristol on 1 April

After Saracens’ outrageous flouting of the system, Premiership Rugby would do well to ensure that respect for the cap - whatever its level - is maintained. Stick (as in a recent Leicester Tigers fine for historic breaches) and carrot will both help. The pandemic system only allows one marquee player whose costs sit outside the cap. It used to be two. A return to the double would be a winner for fans and ambitious owners. As would a bump back up to the earlier £6.4 million ceiling.

How, though, to nurture the more ambitious and wealthy owners when the Premiership is increasingly looking like a closed league with a tight spending cap? The answer may be to allow controlled spending above the cap at the cost of, say, a 100% surcharge on any overage. This could then be distributed among the other clubs, to spend on additional player costs or bolster their bank accounts as they see fit. Major League Baseball has a much more sophisticated ‘luxury tax’ system with the same purpose. The New York Yankees take advantage of it every year. And rarely triumph either.

Twenty tales of two tables

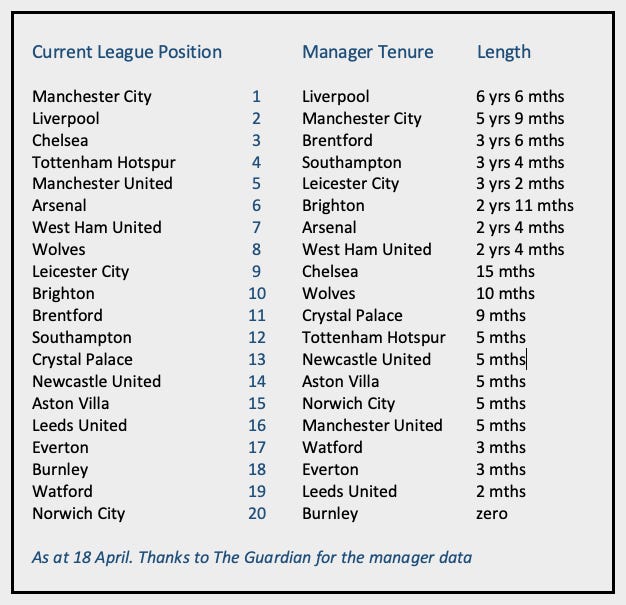

Burnley’s sacking of Sean Dyche makes nine Premier League clubs without the same manager who started the season back in August. A pretty normal year then. Juxtaposing current league standings against a ranking of manager tenures tells twenty tales of expectations, balance sheets, fears and histories.

You can pick your own stories out of the table below. I’ll just flag four from the factors above. Expectations: Manchester United. Balance sheets: Newcastle United. Fears: Everton. Histories: Tottenham Hotspur.

The other mid-season churns are the now traditional, desperate attempts by clubs who might bounce between Premier League and Championship to cling onto top flight status.

There is a sense within the game that the tide is now flowing more strongly than ever in favour of the so-called ‘big six’ at the expense of the other fourteen and the stronger Championship clubs. This will only further increase the value of managers in both segments of the league - either to be competitive in the heavyweight division, or to triumph in the battle of the have-lesses.

The average manager tenure across the twenty is 21 months. It’s reported that Sean Dyche had three years left on a £5 million plus a year contract when he was sacked. Doubtless he’ll be back in work in time for the 2022/23 season should he want to.

Toeing the supply line

“I have no toenails. It was just my foot, my shoes, they’ve just been sliding around a lot.” Emma Raducanu in Prague last week

Hard to read Emma Raducanu on her lack of toenails without thinking that Nike’s entire stock of the tennis star’s favourite shoes in a half size smaller must be stuck on a containership in a far-flung corner of the world, victim of the global supply-chain crisis.

Summertime

Lunch at the KIA Oval, 15 April. Photo courtesy of Alex Warner, cricket nut